In a fintech landscape crowded with cashback clones and loyalty lookalikes, Roshni Aslam stands out as the quiet force redefining how India earns, saves, and invest. As the Co-founder & Head of Finance at GoSats, India’s first Bitcoin and Gold rewards platform, Roshni has built more than a fintech product; she has architected a behavioural shift in the world of finance.

Where most companies chase instant gratification, she designed a model rooted in aspiration: pairing Bitcoin — the digital frontier of wealth — with Gold, India’s most trusted asset. This duality isn’t just smart, it’s culturally intuitive. Under her watch, GoSats transformed everyday spending into a gateway for financial empowerment, making assets that once intimidated the average Indian feel accessible, familiar, and even exciting.

With regulatory landscapes that change faster than market charts, Roshni has steered GoSats with a calm, compliance-first discipline, proving that innovation and safety can — and must — coexist. Her approach to user psychology is equally sharp: start small, reward often, communicate transparently, and let confidence compound organically. It’s a philosophy that has brought hundreds of thousands of users into the world of micro-investing without the fear, jargon, or volatility panic that usually surrounds crypto.

In an industry where women are still underrepresented, Roshni has become a voice shaping not just adoption but inclusion — with onboarding systems designed for safety, education rooted in practicality, and community models that empower women to invest at their own pace.

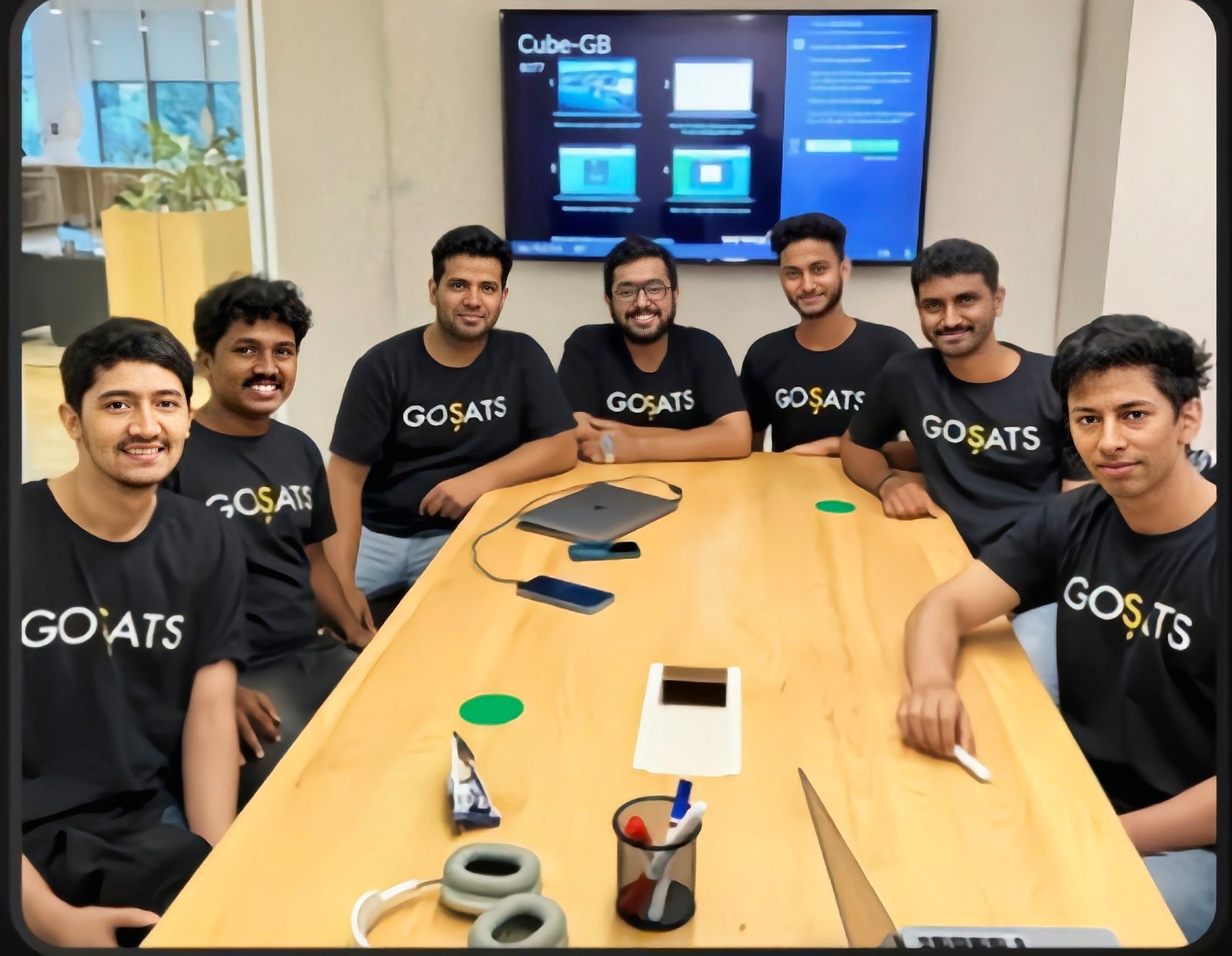

Today, with 200+ brand partnerships, a rapidly growing user base, and a rewards model that blends trust with innovation, Roshni Aslam along with fellow Co-founder Mohammed Roshan Aslam are not just building a company, they are helping rewrite how India thinks about value, loyalty, and wealth-building. Her leadership embodies the future of rewards: intuitive, resilient, culturally aligned, and built on the unshakeable pillars of transparency and trust.

In an exclusive interview with Sumita Chakraborty, Founder & Editor-in-chief, TheGlitz, Roshni Aslam, Co-founder, GoSats talks about how they are steering GoSats into a new era — where every purchase is not a transaction, but the first step toward long-term financial confidence.

Over To Roshni Aslam, Co-founder, GoSats

- GoSats entered the market with a disruptive promise: Bitcoin and Gold rewards for everyday spending. First of all why this structure of Bitcoin and Gold rewards? What was the biggest structural resistance you faced in convincing both users and brands to bet on a new asset-driven rewards model?

Bitcoin and Gold together balance innovation with cultural trust. Bitcoin offers high-growth potential as a digital asset, while Gold is a timeless store of value familiar to Indian users. The biggest challenge was overcoming education barriers and regulatory clarity to earn user trust and convince brands of the model’s compliance and scalability.

- India is still navigating regulatory uncertainty around crypto. How does GoSats innovate within these shifting goalposts without compromising user trust or operational stability?

We innovate within India’s evolving crypto regulations by maintaining strict KYC/AML compliance and modular product design. This allows us to quickly adapt between Bitcoin, Gold, or voucher rewards depending on regulatory guidance, ensuring operational stability and sustained user trust.

- Reward ecosystems are becoming increasingly competitive, with fintech companies pushing cashbacks, credit rewards, and loyalty perks. How does GoSats ensure that Bitcoin and Gold remain aspirational — not intimidating — for the average Indian user?

We focus on micro-earning and seamless redemption in small, familiar units to lower barriers. By integrating asset rewards into everyday spend with intuitive UX and relatable campaigns, Bitcoin and Gold feel accessible and aspirational, not complex or intimidating.

- A large portion of India’s population is still financially cautious or crypto-averse. What behavioural insights shaped your product strategy to turn these cautious users into confident, long-term accumulators?

Behavioral insights reveal that frictionless, small, repeat rewards help cautious users build trust gradually. Our product prioritizes ease of earning first and learning later, with goal-setting tools and transparent communication to convert cautious clients into confident, long-term asset accumulators.

- GoSats partners with 200+ major brands. What are the key factors that determine whether a brand truly understands the value of integrating Bitcoin or Gold rewards into their customer retention strategy?

Behavioral insights reveal that frictionless, small, repeat rewards help cautious users build trust gradually. Our product prioritizes ease of earning first and learning later, with goal-setting tools and transparent communication to convert cautious clients into confident, long-term asset accumulators.

- Women remain significantly underrepresented in both crypto investing and fintech leadership. Is this true? If yes, how has GoSats tackled that problem?

Women are underrepresented but their participation is rapidly growing in India’s crypto space. GoSats addresses this with safety-focused onboarding, smaller earn amounts, education tailored to practical goals, and supportive community learning to boost female investor confidence.

- The volatility of Bitcoin is both its greatest draw and biggest fear factor. How do you address concerns around whether rewards in such an unpredictable asset can be considered “safe” or “reliable”?

We position Bitcoin rewards as gradual accumulation, not speculation, using rupee-cost averaging through micro-lots. Offering Gold rewards alongside provides stability, and flexible redemption lets users manage portfolio balance, addressing volatility concerns with transparency and choice

- As the company scales, what is the one strategic risk you’re willing to take — and the one you absolutely won’t — to push GoSats into the future of rewards and micro-investing in India?

“We are willing to take the risk of deeply integrating our rewards with multiple everyday payment methods to make asset accumulation seamless. However, we won’t compromise on regulatory compliance or custodial transparency, as trust and safety remain non-negotiable foundations for growth.” – Roshni Aslam, Co-Founder, GoSats